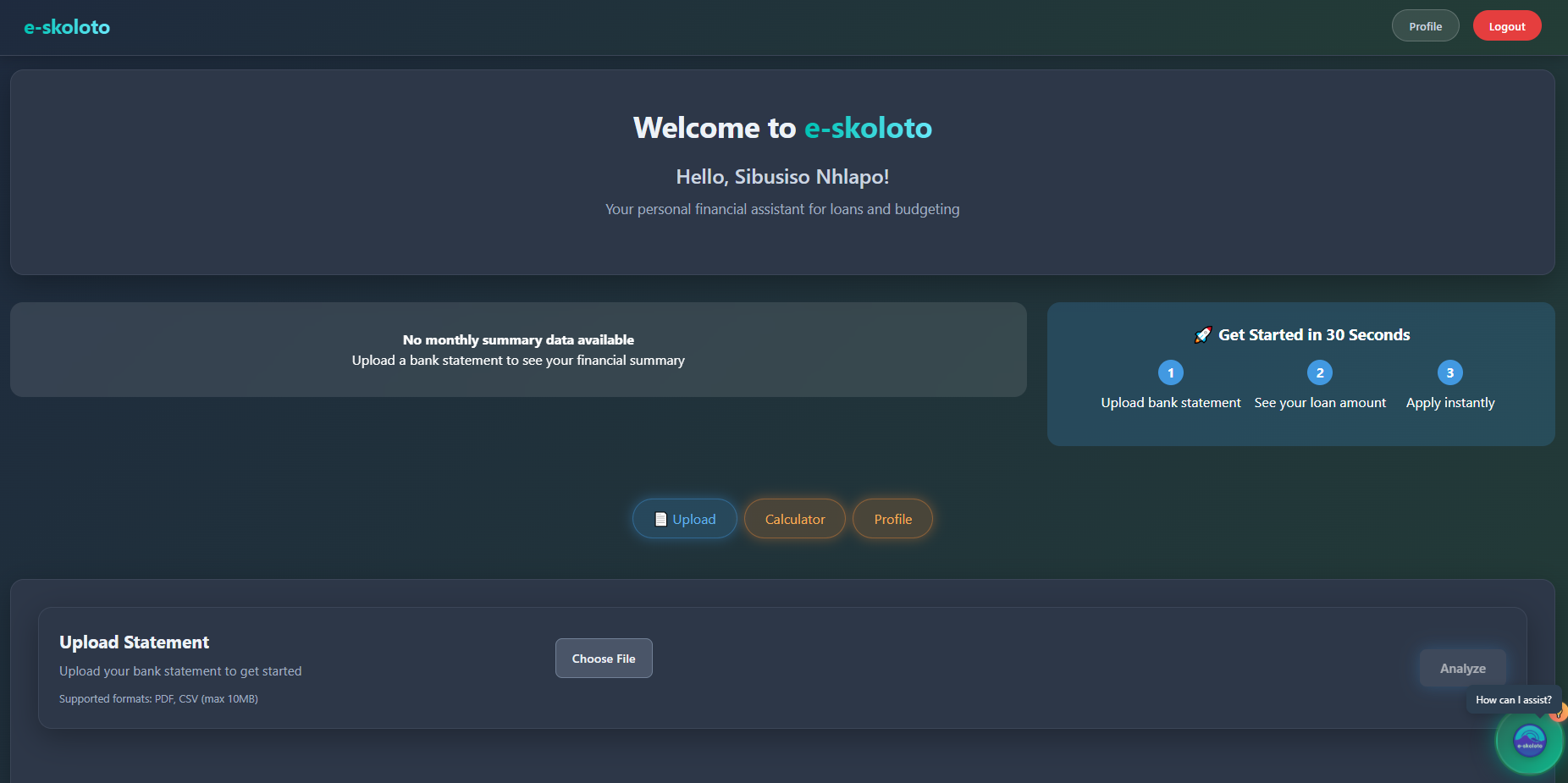

User Dashboard

Product Vision & Market Impact

The Problem We're Solving: Traditional banking dashboards are complex and intimidating for underbanked users, with 82% finding existing financial apps too complicated to use effectively for daily money management.

Our Solution: Simplified, mobile-first financial command center that consolidates all financial activities in one intuitive interface, designed specifically for users with limited digital banking experience.

Market Opportunity: Serving the 23 million banked South Africans who need better financial visibility and control, particularly those managing multiple financial products and services.

Current Stage: Production with active users, 91% find it easier to use than traditional banking apps, average session time 4.2 minutes vs 1.8 minutes industry average.

Main dashboard interface with financial overview and quick actions

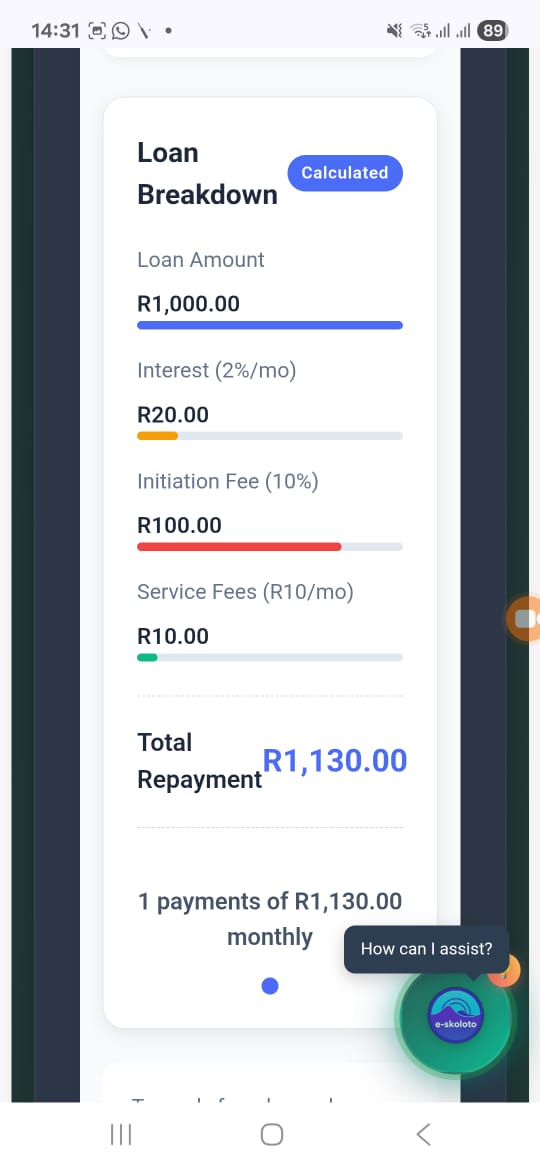

Integrated loan management with payment tracking

Core Capabilities & User Value

📊 Financial Overview

Single-screen view of complete financial health including account balances, recent transactions, loan status, and AI-generated insights - eliminating the need to check multiple apps.

💰 Loan Management

Complete loan lifecycle management from application to repayment, with payment schedules, early settlement options, and real-time status updates all in one place.

🤖 AI Integration

Seamlessly integrated AI assistant, budget analysis, and smart shopping features accessible from the main dashboard without switching between different tools or apps.

🔒 Secure & Simple

Bank-grade security with user-friendly interface designed for mobile-first users, featuring large buttons, clear navigation, and intuitive workflows that reduce user errors.

Development Stage

Status: Production - Fully operational with all core features, serving active users daily

Technology Stack: Next.js frontend with Firebase backend, optimized for mobile-first experience

Performance: Under 2 second load times, 99.9% uptime, optimized for low-bandwidth connections

Security: Multi-factor authentication, encrypted data storage, POPIA compliant user management

Updates: Continuous feature improvements based on user feedback and AI enhancements

User Access & Onboarding

Immediate Access: Available instantly after signup with guided onboarding tour highlighting key features and navigation

Setup Process: Account creation → Profile setup → Bank statement upload → Dashboard personalization → Feature exploration

User Journey: 1) Register → 2) Complete profile → 3) Upload statement → 4) Explore dashboard → 5) Access all integrated features

Live Dashboard: Integrated AI assistant, budget analysis, and loan management in unified interface